Energy Efficiency, GHG Emissions, Industrial - April 1, 2024 - By Department of Energy

Chemicals Value Chain Decarbonization: Integrated Solutions for a Complex Challenge

The chemicals industry is critical for the U.S. economy, supporting more than 25% of the U.S. gross domestic product. However, it is heavily dependent on fossil resources both as a feedstock and for energy and is responsible for 513 million metric tons of energy-related CO2 emissions. Decarbonizing the chemicals sector is an essential part of the strategy to achieve a strong, competitive, and net-zero industrial sector of the future. The U.S. Department of Energy (DOE) Industrial Efficiency and Decarbonization Office (IEDO) is pursuing ambitious pathways to support technology development and collaboration across the entire chemicals value chain. This work includes applied research, development, and demonstration (RD&D) of next-generation technologies and aligns with DOE’s Clean Fuels & Products Shot™ to support sustainable feedstocks for carbon-based products.

End products produced in today’s economy relies on raw materials that make up “building block” chemicals, responsible for 75% of emissions from all chemicals and petrochemicals produced in the United States. (Graphic by the U.S. Department of Energy)

The chemicals sector is dominated, both in production volume and emissions, by several “building block” chemicals – ammonia, ethylene, propylene, BTX aromatics (benzene, toluene, xylene), and methanol. In fact, 18 of the largest volume chemicals are responsible for more than 75% of emissions from all chemicals and petrochemicals produced in the United States. As the nation looks to rapidly decarbonize the industry, the disproportionate production and resulting emissions from these few building block chemicals has led to an equally disproportionate level of investment and resources. But investing solely in decarbonization technologies for these high-volume chemicals will not be enough to achieve a net-zero chemicals sector.

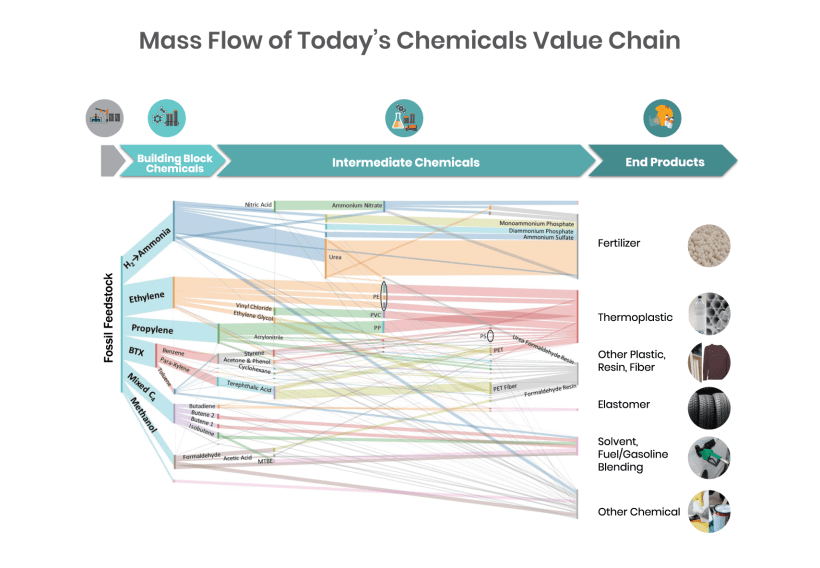

The chemicals industry currently converts raw materials into over 70,000 different products. It is incredibly intricate, diverse, and interconnected, with changes in feedstocks and upstream chemicals triggering a ripple effect down the value chain. The graphic below illustrates a simplified diagram of global materials flow through the petrochemical industry—from fossil feedstock to final products.

A simplified diagram of global materials flow through the petrochemical industry—from fossil feedstock to final products. Produced referencing data published in Environmental Science & Technology. (Graphic by the U.S. Department of Energy)

Due to this complex supply chain, reducing emissions from the production of high-volume chemicals can only address a portion of our larger decarbonization solution. Connections must also be made at multiple steps down the value chain to build pathways from feedstocks to final products like specialty chemicals, thermoplastics, and textiles. For example, changes to upstream chemicals from sustainable feedstocks or from advanced production methods, such as electrochemical and membrane reactors, must be compatible with downstream processes.

Industrial stakeholders at recent IEDO events have highlighted the need to address the technical challenges related to integrating a new technology with both upstream and downstream processes. For example, stakeholders identified supply chain and market barriers as key themes at both the 2020 and 2023 Sustainable Chemistry Roundtables. Discussion surrounded the challenges presented by highly optimized platform chemical supply chains, which make it difficult for new solutions to break into the market. Scaling up new chemical processes includes capital and operational expenditure risks, making it difficult to justify industry investment without commitment from a specific buyer. Incumbent chemical properties have been optimized to support specific customer requests and new products often have slight differences in properties that do not integrate seamlessly with the rest of the value chain. Downstream customers may have to make substantial capital investments to accommodate the new renewable product or expose themselves to additional supply chain risks by sourcing from a single sustainable supplier. Thus, while huge decarbonization opportunities exist, it is critical to have collaboration and buy-in across the value chain to realize this potential.

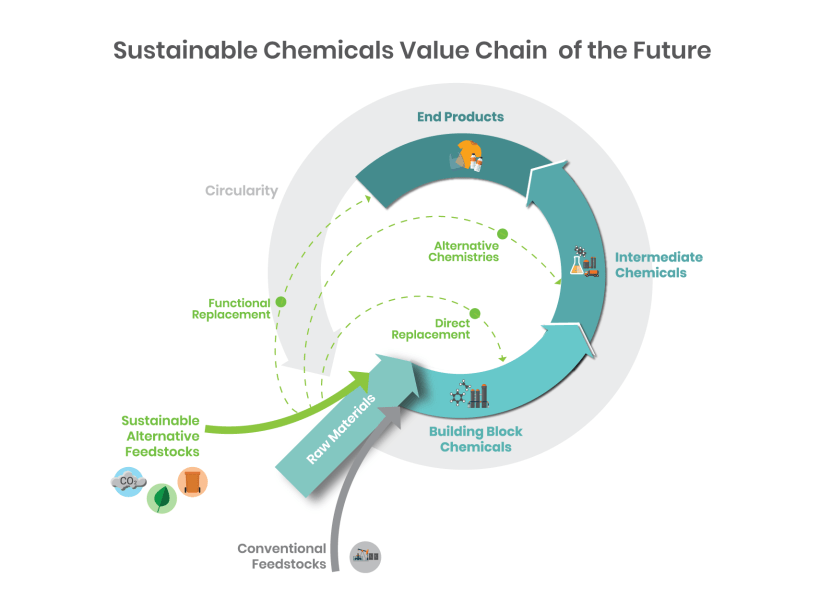

Solutions can target direct replacements to incumbent chemicals and intermediates, or new, sustainable supply chains for functional replacements to downstream products. Sustainable alternative feedstocks might include industrial waste gases (CO2, CO, CH4), biomass, recovered plastics, and industrial, agricultural, or municipal solid wastes, among others. As research progresses, it is important to consider supply chain risks associated with the over reliance on a particular bioresource or alternative feedstocks. New chemical technologies need to be integrated with downstream processes. Likewise, technologies for converting alternative feedstocks must address upstream considerations including resources to meet the high-volume demand of chemical products; robust processes capable of handling heterogeneity of realistic feedstocks; and minimization of feedstock-related emissions, water use, and environmental impacts.

Achieving deep decarbonization of the chemicals sector will require a multidimensional approach, including sustainable feedstocks, low-carbon energy, and advanced unit operations. In all cases, the research phase should incorporate multiple perspectives from the chemical value chain in order to assess required purities, product standards, emissions impact, techno-economics, and scalability from feedstocks to end products. To progress from a myriad of possibilities to reality, it is important for researchers and investors to consider which solutions have the greatest potential for both commercialization and decarbonization. Considering broader supply chain implications during technology development can help remove barriers for promising research, promote collaboration, and appropriately target research goals.

Considering broader supply chain implications during technology development can help remove barriers for promising research, promote collaboration, and appropriately target research goals. (Graphic by the U.S. Department of Energy)

This column originally appeared on the U.S. Department of Energy website.

This column originally appeared on the U.S. Department of Energy website.

IEDO is committed to accelerating cost-effective innovations across the chemicals value chain through RD&D investments. IEDO’s most recent energy- and emissions-intensive funding opportunity includes an area of interest for chemical value chain decarbonization. By fostering RD&D for solutions across the full chemicals value chain, IEDO will help decarbonize the industrial sector and put the nation on a path toward achieving a net-zero economy by 2050.

Learn more about IEDO’s 2024 energy- and emissions-intensive funding opportunity and IEDO's work in applied research, development, and first-of-a-kind demonstrations. To support industrial decarbonization, DOE has also launched several Energy Earthshots™. Learn more about DOE’s Clean Fuels and Products Shot™ and Industrial Heat Shot™.

Read These Related Articles:

- MGM Resorts’ 100-Megawatt Solar Array: Climate Action Through Solar Farming

- Decarbonizing the U.S. Economy by 2050: A National Blueprint for the Buildings Sector

- DOE Transmission Interconnection Roadmap: Transforming Bulk Transmission Interconnection by 2035

- DOE signs MOU to Accelerate Long-Duration Energy Storage

- DOE Invests $2.2B in Grid Improvement

Stay Up-To-Date